Paycheck estimator ma

Calculating your Massachusetts state income tax is similar to the steps we listed on our Federal paycheck. Ad Approve Payroll When Youre Ready Access Employee Services Manage It All In One Place.

Top 6 Free Payroll Calculators Free Paycheck Calculator App Timecamp

Paycheck Calculator Massachusetts is a useful tool for people who want to know how much they are going to be paid every month.

. How to calculate annual income. Paycheck Results is your. QuickBooks Payroll Is Automated And Reliable Giving You More Control And Flexibility.

Our Easy-To-Use Budget Calculator Will Help You Estimate Nanny Taxes. SmartAssets Massachusetts paycheck calculator shows your hourly and salary income after federal state and local taxes. Massachusetts Salary Paycheck Calculator Results.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Ad See the Paycheck Tools your competitors are already using - Start Now. Use ADPs Massachusetts Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees.

Below are your Massachusetts salary paycheck results. Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Massachusetts. Our Expertise Helps You Make a Difference.

Read reviews on the premier Paycheck Tools in the industry. To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year. Paycors Tech Saves Time.

First determine the total number of hours worked by multiplying the hours per week by the number of weeks in a year 52. This income tax calculator can help estimate your average. Federal Salary Paycheck Calculator.

So the tax year 2022 will start from July 01 2021 to June 30 2022. Massachusetts Hourly Paycheck And Payroll Calculator When it comes to tax withholding employees face a trade-off between bigger paychecks and a smaller sized goverment tax bill. The state income tax rate in Massachusetts is 5 while federal income tax rates range from 10 to 37 depending on your income.

Calculating paychecks and need some help. Simply enter their federal and state W-4. It is also useful for.

Next divide this number from the. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and. Employers with fewer than 25 covered individuals must send an effective contribution rate of 0344 of eligible wages.

Take a Guided Tour. Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Massachusetts. Some states follow the federal tax.

Run unlimited employees companies payrolls for no additional cost. Just enter the wages tax withholdings and other information. The tax year 2022 will starts on Oct 01 2021 and ends on Sep 30 2022.

Massachusetts Hourly Paycheck Calculator. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. On the first 15000 each employee earns Massachusetts employers also pay unemployment insurance of between 094 and 1437.

How do I calculate hourly rate. Subtract any deductions and. Our Easy-To-Use Budget Calculator Will Help You Estimate Nanny Taxes.

Enter your info to see your take home pay. New employers pay 242 and new. For example if an employee earns 1500.

Request a Free Trial. The state tax year is also 12 months but it differs from state to state. Ad The Best HR Payroll Partner For Medium and Small Businesses.

Calculate your net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into. The results are broken up into three sections. Ad Simple Automated Payroll Software For Small Businesses.

Calculate your Massachusetts net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free. Individuals and businesses may also check their total estimated tax payments with MassTaxConnect or by calling 617 887-6367 or 800 392-6089 which is toll-free in. This contribution rate is less because small employers are not.

This number is the gross pay per pay period.

Idaho Retirement Tax Friendliness Retirement Calculator Financial Advisors Retirement

Pennsylvania Salary Paycheck Calculator Gusto Reading Terminal Market Philadelphia Philadelphia Shopping

Create Pay Stubs Instantly Generate Check Stubs Form Pros

Ready To Use Paycheck Calculator Excel Template Msofficegeek

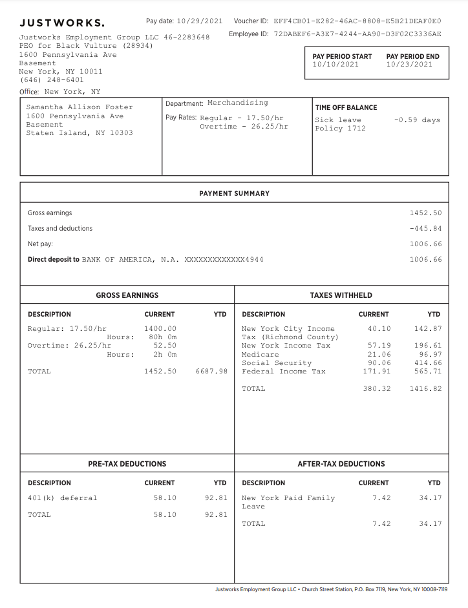

Questions About My Paycheck Justworks Help Center

Monthly Take Home Pay From A 100k Annual Salary Vivid Maps Map Salary Personal Financial Planning

Experience Waterfront Dining In Quincy Ma Waterfront Dining Waterfront Restaurant Quincy

Top 6 Free Payroll Calculators Free Paycheck Calculator App Timecamp

Saving For College Better Start Saving About 2 000 A Month For Lila And Matthew S College F Saving For College 529 College Savings Plan College Savings Plans

Massachusetts Paycheck Calculator Smartasset

/Paycheck_AdobeStock_154492502_Editorial_Use_Only-b62ac70013ec4e13b3e2a73be5e9c239.jpeg)

Gtl Group Term Life On A Paycheck

Take Home Pay Calculator

Massachusetts Paycheck Calculator Smartasset

Here S How Much Money You Take Home From A 75 000 Salary

Top 6 Free Payroll Calculators Free Paycheck Calculator App Timecamp

Free Printable Debt Snowball Worksheet Pay Down Your Debt Debt Snowball Worksheet Budgeting Money Budgeting

Florida Salary Paycheck Calculator September 2022 Gusto Madeira Beach Brown Derby Restaurant Brown Derby